The accounting profession is undergoing a profound transformation driven by various accounting trends that are reshaping how financial professionals work and interact with businesses. These trends, fueled by technological advancements, regulatory changes, and shifting client demands, have shifted accountants’ roles from traditional number crunchers to strategic business advisors. Financial professionals today are not only focused on ensuring compliance and managing finances, but they are also embracing new tools and strategies to provide valuable insights and improve decision-making processes. In this article, we explore the top accounting trends revolutionizing the role of financial professionals.

Automation in Accounting: Redefining Efficiency

One of the most significant accounting trends of recent years is the rise of automation, particularly through tools like Robotic Process Automation (RPA). Automation is streamlining many repetitive tasks such as data entry, invoice processing, payroll management, and reconciliations. These tasks, which traditionally consumed significant amounts of time, are now performed faster and with fewer errors, allowing accountants to focus on more strategic functions.

RPA software is programmed to handle rule-based activities, eliminating the need for accountants to manually input data or perform routine calculations. By automating these mundane tasks, accountants can reduce human error and increase the accuracy and efficiency of financial operations. Automation is particularly beneficial in reducing operating costs, improving productivity, and enhancing the overall client experience. Financial professionals now find themselves with more time to focus on tasks that require judgment, such as financial planning, analysis, and advisory services.

As this accounting trend continues to grow, financial professionals are becoming more adept at implementing automation technologies to optimize workflows and free up resources for higher-value activities.

Cloud Accounting: Enhancing Collaboration and Accessibility

Another major accounting trend is the widespread adoption of cloud-based accounting systems. Cloud accounting has changed the way financial professionals and businesses manage their financial data, offering several key advantages over traditional on-premises software. With cloud accounting, financial data is stored online, allowing both accountants and clients to access it in real-time, from anywhere in the world.

This level of accessibility and collaboration is empowering financial professionals to be more responsive and proactive with their clients. For example, accountants can provide real-time insights into a client’s financial position and make adjustments as needed. Cloud accounting tools also enable better collaboration between accountants, clients, and other team members, as they can all work on the same set of financial data simultaneously.

Cloud-based systems also improve data security by offering automatic backups, encryption, and multi-layered authentication. Additionally, cloud accounting solutions can integrate with other business management tools, such as inventory, payroll, and customer relationship management (CRM) software, creating a unified ecosystem for managing business operations.

This shift to cloud-based accounting is helping financial professionals be more agile, and it is shaping the future of accounting trends by promoting a more integrated and real-time approach to financial management.

Data Analytics: Leveraging Financial Insights

As businesses generate more data than ever before, accounting trends have evolved to embrace data analytics as a powerful tool in financial management. The ability to process and analyze vast amounts of data allows accountants to uncover valuable insights, identify trends, and make better-informed decisions.

Data analytics is now being used to provide actionable insights for forecasting, budgeting, and strategic planning. Accountants are able to analyze patterns in sales, customer behavior, or operating costs, and use these findings to optimize financial strategies. For example, accountants can help businesses assess which products or services are most profitable, predict future financial outcomes, and identify areas for cost reduction.

With the rise of accounting trends such as predictive analytics, accountants can move beyond basic reporting and help businesses make data-driven decisions that enhance profitability and efficiency. Accountants skilled in data analysis are becoming more sought after, as their ability to present complex data in an understandable and actionable manner helps businesses make informed, strategic decisions.

Artificial Intelligence (AI) and Machine Learning (ML): Transforming Decision-Making

Artificial Intelligence (AI) and Machine Learning (ML) are two accounting trends that are taking automation and data analytics to the next level. AI and ML systems have the ability to process massive amounts of data and uncover patterns that may be difficult for humans to detect.

For example, AI-powered systems can detect anomalies in financial transactions, flagging them as potential fraud. Additionally, machine learning algorithms can analyze past financial data to predict future trends, such as cash flow projections or potential financial risks. These tools enable financial professionals to provide more accurate forecasts and advise clients with a higher degree of confidence.

AI and ML are also improving efficiency by automating complex processes that once required human intervention, such as reconciling bank statements or matching transactions to accounting entries. As accounting trends continue to evolve, these technologies will play an even larger role in simplifying financial operations and improving decision-making.

Blockchain Technology: Enhancing Transparency and Security

BT, often associated with cryptocurrencies, is emerging as an important tool in the accounting field. Blockchain provides a decentralized, tamper-proof ledger that records transactions in a transparent and secure manner. For financial professionals, blockchain offers significant benefits in areas such as auditing, fraud prevention, and financial reporting.

Blockchain allows accountants to create secure, transparent records, reducing fraud by making transactions visible and preventing undetected alterations.

In addition to increasing security, blockchain also reduces the need for intermediaries in financial transactions, streamlining processes and cutting costs.This transformative accounting trend changes how professionals manage and share financial data, creating a more efficient and reliable financial ecosystem.

Advisory Services: Moving Beyond Traditional Accounting

As technology evolves, accountants shift from compliance to advisory roles, aiding businesses with strategy, growth, and decision-making.

Accountants are evolving into trusted advisors, offering insights on forecasting, strategy, and tax planning, requiring strong communication skills.

The demand for more personalized financial advice drives the shift toward advisory services. Businesses are looking for accountants who can help them navigate complex financial landscapes and make informed decisions. This accounting trend is redefining the role of accountants, positioning them as integral partners in driving business success.

The Evolving Role of Financial Professionals

Accounting trends is evolving, requiring professionals to go beyond bookkeeping, offering strategic guidance, leveraging technology, and driving business success.

Accounting is evolving with AI, automation, data analytics, blockchain, and advisory roles, empowering professionals to drive strategic business success.

Embracing trends positions financial professionals to lead organizations or clients to success in today’s competitive, data-driven business environment.

Conclusion

The accounting trends discussed in this article are revolutionizing the profession, creating new opportunities for financial professionals. From automation and cloud accounting to data analytics, AI, blockchain, and advisory services.

Related Posts

Berpikir Sistematis: Skill Wajib Mahasiswa Masa Kini

Berpikir Sistematis: Skill Wajib Mahasiswa Masa Kini

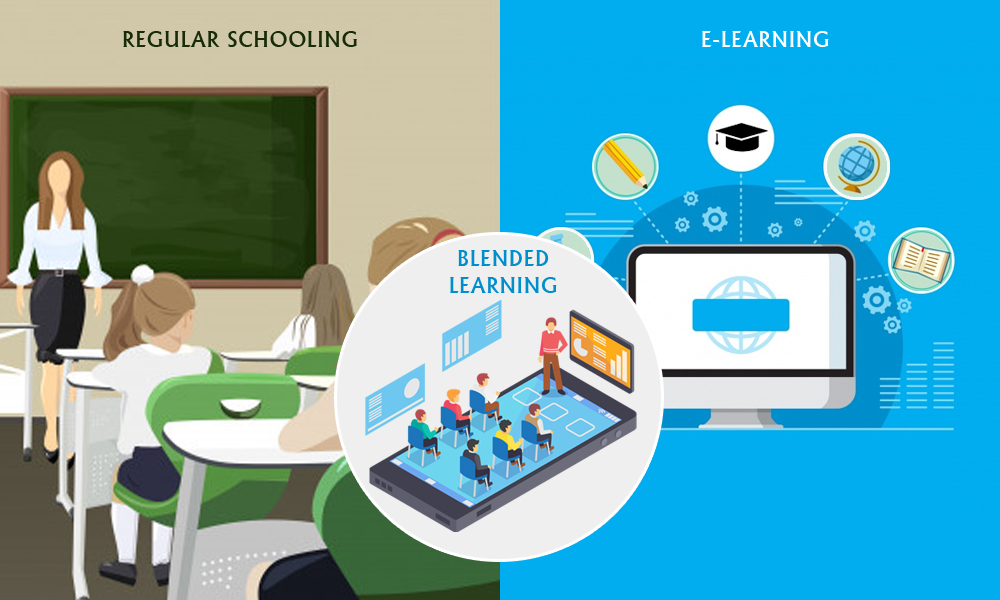

Pembelajaran Hybrid: Wajah Baru Dunia Kampus di Tengah Perubahan Zaman

Pembelajaran Hybrid: Wajah Baru Dunia Kampus di Tengah Perubahan Zaman

Kalkulus Lanjut: Pilar Pemahaman Matematika Tingkat Tinggi

Kalkulus Lanjut: Pilar Pemahaman Matematika Tingkat Tinggi

Paramedicine Skills: Providing Urgent Care in College—What I Wish I Knew

Paramedicine Skills: Providing Urgent Care in College—What I Wish I Knew